In 2016, Bitcoin was a red flag 🚩

In 2025, it’s officially recognized as a financial security.

Nigeria’s journey with cryptocurrency has been anything but linear. What began as a response to economic crises has evolved into one of the most significant digital finance stories in Africa. With a landscape marked by regulatory uncertainties, warnings, outright bans, and later, groundbreaking innovation, the country’s trajectory with digital currencies is a remarkable example of how a nation can navigate the complexities of this new frontier.

However, the pivotal moment in Nigeria’s crypto journey came in early 2025, when the Investments and Securities Act (ISA) 2024 officially recognized cryptocurrency as a financial security. This transformative legislation brought cryptocurrencies under the regulatory umbrella of the Securities and Exchange Commission of Nigeria. What once seemed like a volatile and unregulated space is now being treated as a legitimate financial asset class, with a clear set of rules to govern its use and trade.

This move is not just a regulatory win, it represents a major shift in the country’s mindset. Cryptocurrency is no longer viewed as a speculative threat, nor is it relegated to the realm of fringe investments. Instead, it is recognized as a crucial component of the financial ecosystem, which has broader implications for Nigeria’s growing digital economy.

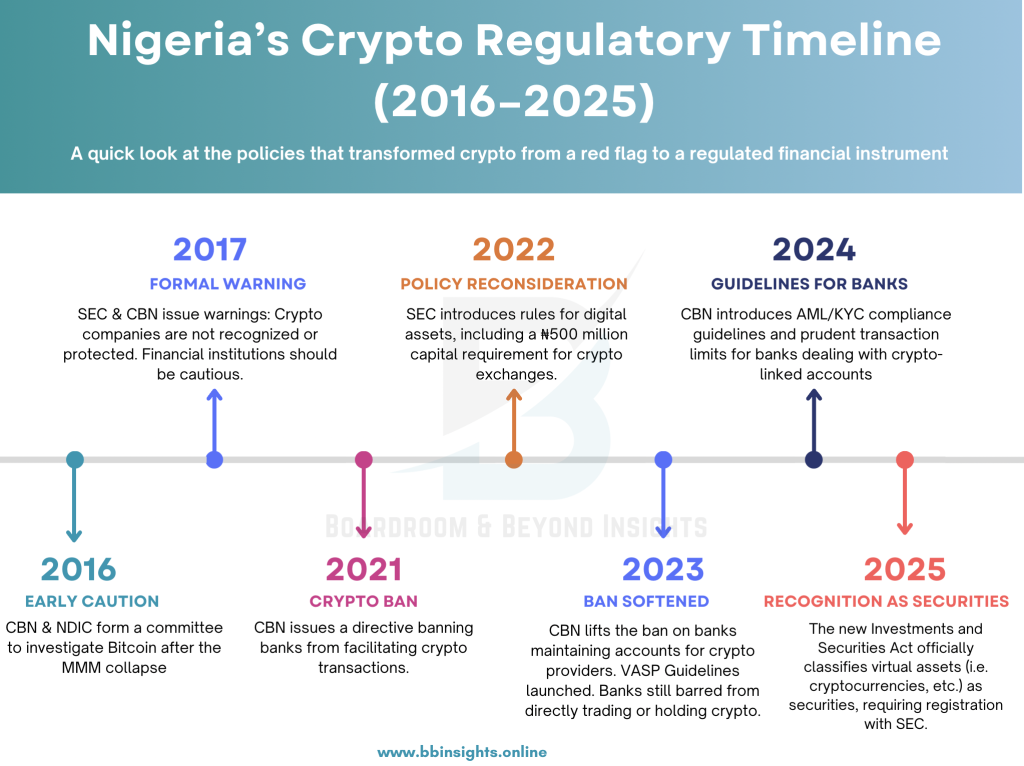

🔵 𝐖𝐞’𝐯𝐞 𝐜𝐚𝐩𝐭𝐮𝐫𝐞𝐝 𝐭𝐡𝐞 𝐟𝐮𝐥𝐥 𝐭𝐢𝐦𝐞𝐥𝐢𝐧𝐞 𝐢𝐧 𝐭𝐡𝐞 𝐯𝐢𝐬𝐮𝐚𝐥 𝐢𝐧𝐟𝐨𝐠𝐫𝐚𝐩𝐡𝐢𝐜 𝐛𝐞𝐥𝐨𝐰 – 𝐀 𝐛𝐫𝐞𝐚𝐤𝐝𝐨𝐰𝐧 𝐨𝐟 𝐍𝐢𝐠𝐞𝐫𝐢𝐚’𝐬 𝐤𝐞𝐲 𝐜𝐫𝐲𝐩𝐭𝐨 𝐫𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐭𝐮𝐫𝐧𝐢𝐧𝐠 𝐩𝐨𝐢𝐧𝐭𝐬 𝐟𝐫𝐨𝐦 𝟐𝟎𝟏𝟔 𝐭𝐨 𝟐𝟎𝟐𝟓:

What This Means for fintechs & Virtual Asset Service providers (vASPs)

Nigeria’s cryptocurrency market is no longer in a state of legal uncertainty. It is now a structured, regulated, and increasingly transparent space. While this is a positive development for the industry as a whole, it also means that all entities involved in digital asset transactions must adhere to the newly established rules. Here’s what this regulatory shift means for Fintechs and VASPs operating in Nigeria:

- Licensing is Now Mandatory: One of the most significant changes under the new regulation is the mandatory licensing requirement for all crypto-related businesses. If you’re operating a digital asset exchange, wallet service, or involved in any crypto transactions, you must now be registered with the SEC. Failure to comply will lead to penalties or the suspension of operations.

- Compliance is Non-Negotiable: As part of the new framework, Fintechs and VASPs will need to establish robust compliance structures. This includes Anti-Money Laundering (AML) practices, Know Your Customer (KYC) procedures, risk management systems, and regular disclosures. Businesses must implement measures that ensure the integrity and security of their operations, protecting both investors and the broader economy.

- Legitimacy and Investor Trust: Perhaps one of the most exciting aspects of this regulatory overhaul is that it brings legitimacy to the crypto space. In an environment where cryptocurrencies were once seen as risky or speculative investments, regulation now assures investors that their assets are safeguarded by the government’s legal framework. This increased trust could lead to a rise in institutional investment, fostering more substantial market growth.

- Room for Sustainable Growth: With regulation comes the opportunity for businesses to scale more effectively. By operating within a structured legal environment, fintechs and VASPs can attract investment, expand their operations, and reach new markets. The clarity provided by regulation offers a stable foundation for innovation, enabling entrepreneurs to focus on developing new solutions without fear of sudden policy changes or government bans.

The Road Ahead for Cryptocurrency in Nigeria

The recognition of cryptocurrency as a financial security is just the beginning. Nigeria’s crypto market is set to continue evolving, with more robust regulations, innovations in blockchain technology, and the potential for increased adoption across the African continent.

As the regulatory environment continues to mature, it’s important to monitor further developments closely. For Fintechs, VASPs, and crypto enthusiasts, the opportunities are vast, but so are the responsibilities. Operating within the framework of the law will be critical to success in this dynamic and rapidly evolving space.

Nigeria has transitioned from viewing cryptocurrency with skepticism to embracing it as an integral part of its financial ecosystem. With the landmark recognition of crypto as a financial security, the stage is set for a more stable, innovative, and transparent digital finance environment. For fintechs, VASPs, and investors, the future of crypto in Nigeria looks brighter than ever before.

✍🏾 Researcher & Writer: Ifunanya Anyene

🔍 Editor: Tayo Mustapha, CG (Affiliated)

Leave a Reply